WHAT IS ESG?

ESG is the now well-known acronym for a framework that focuses stakeholders on environmental, social, and governance risks and opportunities. ESG’s origins are in sustainability, with a more recent shift to corporate responsibility (CR) or corporate social responsibility (CSR). It is really over the last couple of years that ESG has firmly taken over as the focus of sustainability in the corporate context.

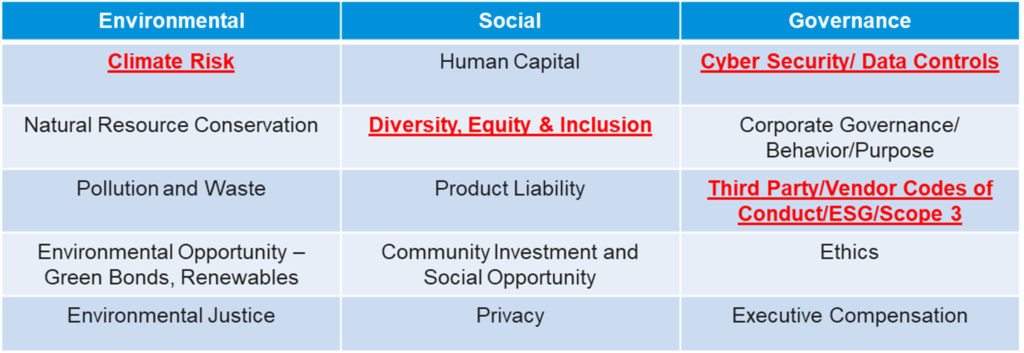

The above chart lays out some of the most topical ESG risks and opportunities, breaking them down into the relevant ESG factors, and underscoring the risks and opportunities of the highest focus.

In the real estate industry, ESG initiatives are becoming a central risk mitigation factor in creating real estate value, as well as a critical component of real estate investment. At its core, ESG is about incorporating what economists might call externalities (such as the environment, community, and employees) more directly into investment strategies. For decades, the guiding principle of investment theory has been to focus on shareholder returns and to ignore external factors outside the classic real estate fundamentals. But increasingly, stakeholders recognize that many of these externalities play a large role in mitigating risks, adding value, and driving returns. As Larry Fink said in his 2022 letter to CEOs, “We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients.”1

In our view, ESG has reached a tipping point in investing. In a 2019 McKinsey survey, 57 percent of CEO respondents said they believe ESG programs create long-term value, and 83 percent said they expect ESG programs to contribute more shareholder value than they do today.2 In 2020, ESG funds more than doubled in net new money inflows, capturing $51.1 billion.

ESG’s growth in recent years is fueled by multiple drivers, including consumer shifts, regulatory requirements, trillions of dollars of wealth transferring to Generation Z, millennials committed to philanthropic living (not giving), a blurring of work and societal expectations, and a full sprint to attract and retain top talent. PwC’s 25th Annual Global CEO Survey found that 33 percent of CEOs are concerned about climate change threatening their organization’s growth (up from 24 percent in 2020)—a growing aspect of the ESG puzzle.3 Investor and market demand for ESG in real estate spans the globe with senior management asking key questions, including:

- What is material?

- Where are we vulnerable?

- Which strategies will cost-effectively mitigate risks?

For the first time in history, a Dutch court ordered a private company, Royal Dutch Shell PLC, to slash its greenhouse gas emissions by 45 percent from 2019 levels by 2030.4 In a record-high vote on an environmentally oriented shareholder proposal that was opposed by management, 81.2 percent of investors of DuPont supported a resolution asking the company to report on spills of plastic pellets that are released into the environment. According to Heidi Welsh, executive director of the Sustainable Investments Institute, this is “the highest vote ever for a shareholder resolution on an environmental issue that was opposed by management.”5 These examples are not isolated instances; rather they are indicative of continued and increasing shareholder activism in the climate change and ESG space.

Transformative, enterprise-wide ESG programs in all sectors of real estate can be one of the best ways to reduce carbon emissions, accrete value, and demonstrate reputational value. Many private equity and real estate firms have set bold ESG commitments, but perhaps one of the most watched organizations is the Blackstone Group which has committed to: (i) “reduce carbon emissions by 15% across all new investments where [Blackstone] control[s] energy usage;”6 (ii) a new target of “at least one-third diverse representation on portfolio company boards for new control investments, starting in the U.S. and Europe;”7 and (iii) a Career Pathways program, which is “designed to create employment opportunities and career mobility at Blackstone’s portfolio companies for people from underserved communities.”8 On January 21, 2022, Blackstone announced the launch of Blackstone Credit’s Sustainable Resources Platform focused on investing in and lending to renewable energy companies and those supporting the energy transition.

SG STANDARDS AND DISCLOSURE REQUIREMENTS

Reporting frameworks

While organizations are setting aggressive ESG targets that will require regular reporting on their progress, rating agencies and voluntary reporting frameworks are increasingly providing transparency and serving as watchdogs. There has been a proliferation of such frameworks, including the Global Reporting Initiative, the Task Force on Climate-Related Financial Disclosures (TCFD), the CDP (formerly the Climate Disclosure Project), GRESB (a real estate-specific ESG performance framework), and the Principles for Responsible Investment. Proxy advisors, such as ISS and Sustainalytics, and rating agencies, such as MSCI and Morning Star, have also created their own ESG ratings. GRESB found that “[p]articipation in the 2020 Assessment grew by 22% to cover 1,299 portfolios … worth more than USD $4.8 trillion.” GRESB noted that the increase, “coming despite the challenges of the COVID-19 crisis, shows an industry responding decisively to the accelerating investor demand for comparable ESG data.”

Commercial Real Estate (CRE) organizations with carbon reduction frameworks are active and continuing to grow in numerous industry frameworks, such as CDP (413 represented), Science Based Targets (72 represented), and TCFD (72 represented). The Net Zero Asset Managers Initiative (87 signatories), and RE 100 (over 300 total organizations) also have sizeable representation from CRE organizations.

ESG standard bearers and disclosure requirements

Investors are increasingly demanding that corporate sustainability disclosures be streamlined and standardized. Work toward the creation of global sustainability standards is already underway. The Technical Readiness Working Group (TRWG) formed by the International Financial Reporting Standards (IFRS) Foundation Trustees recently published prototype climate and general disclosure requirements. These prototype requirements are the result of six months of joint work by representatives of the Climate Disclosure Standards Board, the International Accounting Standards Board, the TCFD, the Value Reporting Foundation (VRF), and the World Economic Forum, supported by the International Organization of Securities Commissions and its Technical Expert Group of securities regulators. The TRWG has consolidated key aspects of these organizations’ content into an enhanced, unified set of recommendations for consideration by the new International Sustainability Standards Board (ISSB).

On November 3, 2021, the IFRS Foundation announced the formation of the ISSB. The new ISSB will be a consolidation of the CDP and the VRF, which houses the Integrated Reporting Framework and the Sustainability Accounting Standards Board (SASB) Standards. The consolidation is expected to be completed by June 2022. The ISSB will develop a “comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities to help them make informed decisions.”9 The standards are intended to facilitate compatibility with jurisdiction-specific requirements or requirements that are intended to cover a broader group of stakeholders. The ISSB will rely on several expert advisory groups in setting standards, including the International Monetary Fund, the Organisation for Economic Co-Operation and Development, the United Nations, and the World Bank, among others.

REGULATORY DEVELOPMENTS

ESG and the SEC

In 2010, the US Securities and Exchange Commission (SEC) issued an interpretive release (the 2010 Climate Change Guidance) to provide guidance to public companies regarding the SEC’s existing disclosure requirements as applicable to climate change. In the 2010 Climate Change Guidance, the SEC summarized rules and regulations that could be the source of disclosure obligations for registrants under federal securities law, including Regulations S-K and S-X. Such disclosure would appear in various sections of a company’s disclosure documents required under the federal securities laws, such as Description of Business, Legal Proceedings, Risk Factors, and Management’s Discussion and Analysis.10

As has been well-publicized, the SEC has progressed in its focus toward climate risk disclosure from its 2010 Climate Change Guidance and continued to acknowledge the increased demand by investors for climate-related disclosures when making their investment decisions.

In February 2021, Acting SEC Chair Allison Herren Lee directed the Division of Corporation Finance to “enhance its focus on climate-related disclosure in public company filings.”11 Specifically, Lee instructed the staff to: (i) review the extent to which public companies are addressing the 2010 Climate Change Guidance; (ii) assess compliance of climate-related disclosures with federal securities laws; and (iii) understand how the market is currently managing climate-related risks. The purpose of this enhanced focus was to update the 2010 Climate Change Guidance.

On April 9, 2021, the SEC issued a risk warning, which cautioned investment advisers, registered investment companies, and private funds that their ESG statements will be more heavily scrutinized.12

In July 2021, SEC Chair Gary Gensler, who assumed his position in April 2021, provided data on the large percentage of high-value companies that produce sustainability reports and set sustainability-related goals. Given the global movement toward more robust ESG related disclosures, he also stated that the SEC staff would “learn from and be inspired by … external standard-setters,” but would “move forward to write rules and establish the appropriate climate risk disclosure regime for our markets.”13

In September 2021, the Division of Corporation Finance released a sample letter to companies regarding climate change disclosures.14 The sample letter highlighted factors that public companies should consider when making climate-related disclosures, including: (i) the material effects of climate-related risks and climate-related legislation, regulations, and international accords on business, financial condition, and results of operations; (ii) material litigation risks related to climate change; and (iii) direct and indirect consequences of climate-related regulation. The sample letter also emphasized the Division of Corporation Finance’s focus on comparing climate-related disclosures in CSR reports and SEC filings, suggesting that the staff may be looking for similarly robust disclosure in SEC filings as are currently provided in CSR reports.

On November 16, 2021, SEC Commissioner Caroline A. Crenshaw, in her remarks at the PepsiCo-PwC CPE conference, provided insight into what she thinks ESG means to the SEC and what ESG regulations could be on the horizon.15 Crenshaw reinforced the notions that: (i) investors view ESG information as material to financial performance; (ii) investors need consistent and reliable disclosure of ESG information to inform their investment decisions; and (iii) the concept of ESG risk is central to any discussion regarding the adequacy of effective internal controls of a company. Crenshaw specifically identified cybersecurity and climate risk as two areas where “it is particularly important to assess whether … existing corporate internal accounting controls are sufficient.”

On March 21, 2022, the SEC proposed mandatory disclosures of climate-related risks, acting under its “broad authority to promulgate disclosure requirements that are ‘necessary or appropriate in the public interest for the protection of investors.’” Although the SEC published guidance in 2010 in which it emphasized that existing disclosure requirements may elicit disclosure about climate-related risks, the SEC noted that because there is “significant inconsistency in the depth and specificity of disclosures” by public companies, the current disclosure system does not adequately address investors’ need for consistent, comparable, and reliable climate-related risk information.

The proposed SEC disclosures are modeled after the required climate-related disclosure on the recommendations set forth by the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas (GHG) Protocol, which the SEC views as potentially mitigating the burden public companies may face in complying with the new rules because many public companies already comply with such recommendations. TCFD focuses on the four prongs of governance, strategy, risk management, and metrics and targets.

The proposal notably requires Scope 1 and Scope 2 disclosures, but also requires a company to disclose under Scope 3 if “material” to the company or if the company has set a GHG emissions target or goal that includes Scope 3 emissions, as many companies have done in making Net Zero commitments. There are various phase-in periods, with the earliest dates applicable for fiscal 2023, and filed in 2024 (assuming a December 22, 2022 rule effective date). An extended comment period expired June 17, 2022. Even though the proposal is in an evaluation period, subject to litigation challenges, and contains phase-in periods, many companies have already been preparing for the requirements, and all should be engaged in understanding the proposed requirements in the interim and developing a roadmap to prepare for current draft rule requirements as they continue to monitor the SEC for changes.

Cybersecurity, which can be categorized as an “S” (social) or “G” (governance) factor depending on the specific risk, has increasingly become a growing concern. Companies largely interact with the public and conduct their business via technology. Companies also make investments in digital assets with corporate cash. These activities make cyber intrusions a natural cause for shareholder concern. The SEC has brought enforcement actions against public companies and regulated entities which did not have adequate internal accounting controls or made inadequate public disclosures concerning cyber intrusions and related risks. Crenshaw noted that she would expect the SEC’s Enforcement and Exams Divisions’ staff to continue to monitor these areas.

Climate risk, which can be categorized as an “E” (environmental) factor, is a growing focus for investors and the SEC. Companies should be assessing whether and how climate change risk impacts their financial health, and discussing the methods used to determine such risk.

On December 6, 2021, the Office of the Chief Accountant (OCA) released a statement outlining its commitment to high quality financial reporting.16 In this statement, the OCA emphasized investors’ desire for more climate-related disclosure and took note of global developments in the ESG disclosure space by highlighting the formation of the ISSB and its mandate to set sustainability disclosure standards on behalf of the IFRS Foundation.

In response to the increased demand from investors and global developments, on March 21, 2022, the SEC proposed new rules that, if adopted, would require public companies to include certain climate-related disclosures in their registration statements and periodic reports, including: (i) information about climate-related risks; (ii) how any such risks have had (or will likely have) a material impact on its financial statements; (iii) how any such risks might affect the company’s business outlook; and (iv) the impact of climate-related events (severe weather events and other natural conditions).17

The commitment of the newly formed ISSB to global disclosure raises interesting questions around potential mandates from the SEC. REITs and other registrants, investors, and providers of capital should continue to monitor the actions of the SEC and be prepared to address these requirements, as well as continuing mandatory energy benchmarking and disclosure requirements at the US state and local levels. Two key areas of focus will be: (i) how the consolidation of disclosure requirements on the global stage may affect a future SEC proposal; and (ii) the extent to which a future SEC proposal will be consistent with other disclosure paradigms.

US developments in the executive and legislative branches

President Joe Biden’s decision to rejoin the Paris Climate Agreement marked a fundamental shift in demands from government and capital sources. In 2021, Biden issued the Executive Order on Tackling the Climate Crisis at Home and Abroad and the Executive Order on Climate-Related Financial Risk (the Biden Executive Orders), the goal of which is “to advance consistent, clear, intelligible, comparable, and accurate disclosure of climate-related financial risk.”18 The Biden Executive Orders firmly pushed climate and carbon risks to the forefront of legislative and regulatory agendas by mandating that all federal agencies (the largest tenant and owner of real estate in the US at over 475 million square feet) make their supply chains more sustainable by mandating certain renewable energy usage and recycled content in their procurement decision-making, as well as mandating the use of electric vehicles for the entire federal fleet. The Biden Executive Orders build on a recent series of regulatory warnings related to ESG frameworks and disclosures. The SEC issued a risk warning stating that the “variability and imprecision of industry ESG definitions and terms can create confusion among investors.”19 Federal Reserve Governor Lael Brainard cautioned that firms failing to establish frameworks to “measure, monitor, and manage climate-related risks could face outsized losses.”20

Federal legislators are also making efforts to advance disclosures on climate risk. For example, on April 15, 2021, a bill was introduced in the House of Representatives, directing the SEC to require public companies to disclose information regarding climate risks, including the company’s strategies and actions to mitigate these risks. On September 15, 2021, the Fossil Free Finance Act was introduced in the House of Representatives. This act would require the Federal Reserve to mandate that bank holding companies with more than $50 billion in assets and other Systemically Important Financial Institutions, align their financing of greenhouse gas emissions and deforestation risk commodities with certain science-based emissions targets based on the Paris Climate Agreement. Among other things, the act would prohibit financing of new or expanded fossil fuel projects after 2022 and all fossil fuel projects after 2030. It would also prohibit thermal coal financing after 2024. Finally, it would mandate a 50 percent reduction in financed emissions by 2030 and a 100 percent reduction in financed emissions by 2050.

Global climate developments

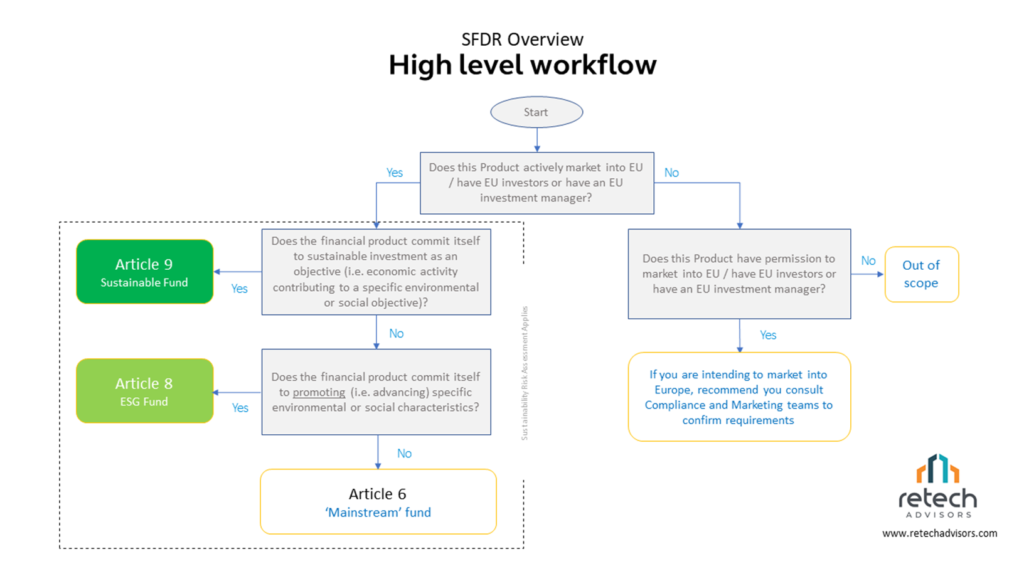

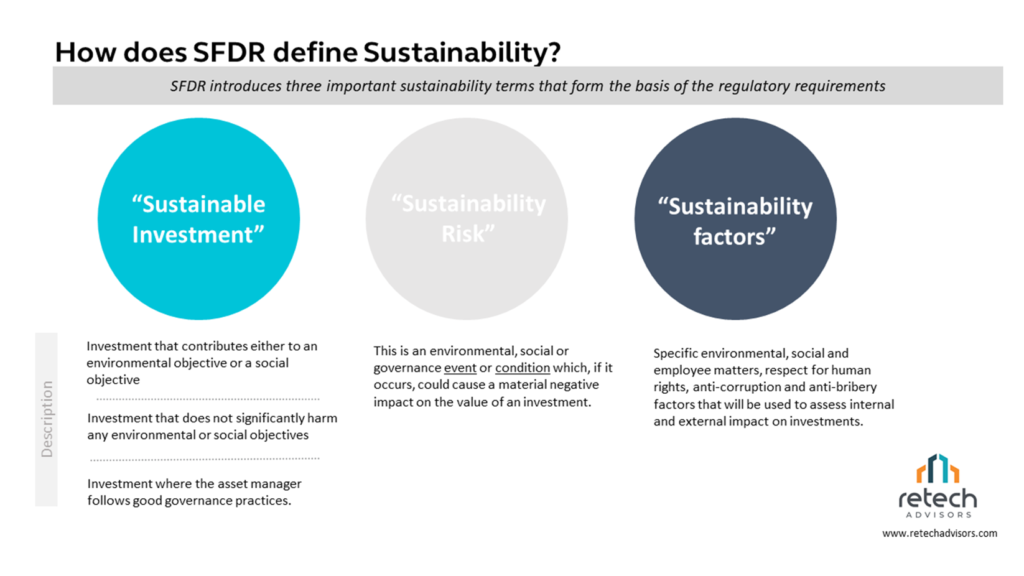

The fast-paced developments in the regulatory landscape will likely drive the most change over the next few years. European Climate Law codifies the EU’s commitment to reaching climate neutrality by 2050 and the intermediate target of reducing net greenhouse gas emissions by at least 55 percent by 2030 compared to 1990 levels. There are several regulatory bodies governing ESG initiatives and reporting in Europe, with two of the largest being the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy. SFDR introduces new ESG transparency and disclosure requirements for financial market participants, mandating that all Financial Market Participants evaluate and disclose ESG data at entity, service, and product level. The purpose of SFDR is to provide a unified ESG disclosure methodology to maintain transparency, inform investors, and prevent greenwashing in the financial market. Likewise, the EU Taxonomy requires financial participants in scope for SFDR to back up claims on environmental characteristics (e.g., ESG or sustainable funds) associated with their products, and report the percentage of their turnover, capital expenditures, and operational expenditures aligned with the EU Taxonomy. Globally, central banks and governments had a planned economic stimulus reaching $15 trillion by early May 2022, according to Reuters, in order to protect their economies from the COVID-19 pandemic.21 However, major economies across the globe are trying to use this as an opportunity for a “green recovery,” with measures aimed at cutting carbon emissions and boosting the economy. This further confirms that ESG has reached a tipping point. Now the expertise, creativity, and innovation that the real estate and finance industries are well-known for need to be applied to assessing risk and deploying strategies to mitigate those risks, while creating value for investors, occupants, and the capital markets that serve them.

ESG INITIATIVES

Carbon neutrality

To address the ESG drivers and access their benefits, in response to growing pressure from many sources as indicated above, and in preparation for mandatory disclosures, unprecedented numbers of companies are conducting greenhouse gas inventories, making commitments to carbon neutrality, emissions reduction goals, or becoming net zero (i.e., not using more energy than is created on-site) by a set date. Sixty percent of Fortune 500 companies have set goals to act on the climate crisis and address energy use, yet those ambitions vary dramatically. Nearly 25 percent of the Department of Energy’s Better Buildings Challenge partners signed onto Better Buildings’ Low Carbon Pilot and will use the partnership as an opportunity to make tactical progress toward decarbonizing their portfolio. Driven by stakeholder (i.e., shareholders, tenants, customers) demand, these commitments present challenges for organizations around funding and implementing the commitments at scale, but also opportunities for collaboration with others and the prospect of lasting change.

Green financing

The demand for progress toward ESG initiatives is encouraging capital markets and financiers to deploy an increasing diversity of financial products to support these goals. Alternative financing options, such as green bonds, energy-as-a-service (EaaS), property-assessed clean energy (PACE), and energy savings performance contracts (ESPCs) are gaining traction in CRE. For example, the commercial PACE market has grown by about 10 times since 2015, and Guidehouse estimates that EaaS will become a $27.2 billion global market by 2029. Many of these specialized financial products are designed not just to provide access to capital, but to shift the complexity of ESG project implementation from the customer to the service provider. Financiers are offering more streamlined and sophisticated services that can support deployment of ESG projects across large building portfolios—in part a response to the growing demand for decarbonization at scale. Commercial Property Assessed Clean Energy (C-PACE) is a financing structure in which building owners borrow money for energy efficiency, renewable energy, and other projects, and make repayments via an assessment on their property tax bill.22 The financing arrangement is recorded in the property’s land records and runs with the land until the C-PACE loan is paid off. Often C-PACE loan terms are 20 to 25 years in duration. C-PACE may be funded by private investors or by governmental programs but it requires local enabling to activate the program. To date, over 152,000 jobs have been created using C-PACE funds and 308,000 different projects have been funded. Currently, $9.3 billion worth of C-PACE loans have been deployed into buildings, resulting in over $18.75 billion of economic impact. C-PACE has been approved in 37 states and the District of Columbia, and C-PACE programs are active in 26 states and the District of Columbia with New Jersey’s regulations expected to be issued in 2022.

Green bonds are another example of a burgeoning industry, not just in the US but globally. Green bonds are part of the landscape of “green investing,” which seeks to support business practices that have a favorable impact on the natural environment. Similar concepts include socially responsible investing, fair trade investing, impact investing, and green tech investing. Green bonds were first issued in 2007 by the European Investment Bank and represented a very small slice of the bond market through 2017. Today, the green bond market is an industry worth over $500 billion, and has been anchored by the Green Bond Principles. The development of these Green Bond Principles in 2014 (updated in 2021) was intended to promote disclosure, transparency, and integrity in the marketplace. Issuers who are using this financing vehicle are seeing a 25 to 40 basis point reduction in their issuing rate of interest, which has resulted in hundreds of millions of dollars of savings for these issuers.

ESG for financial institutions

Some financial institutions have voluntarily started to include disclosures regarding the impact of climate risk in their annual reports or separate sustainability reports. Most financial institutions that make climate disclosures use the TCFD recommendations as a guide. At a high level, the TCFD recommendations seek to orient climate disclosures around four core elements:

- Governance around climate-related risks and opportunities;

- The actual and potential impacts of climate-related risks and opportunities on business, strategy, and financial planning;

- The processes used to identify, assess, and manage climate-related risk; and

- The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

On March 30, 2022, the Federal Deposit Insurance Corporation (FDIC) proposed Statement of Principles for Climate-Related Financial Risk Management for Large Financial Institutions (RIN 3064–ZA32) (Statement of Principles).23 The proposed Statement of Principles provides a high-level framework for the safe and sound management of financial institutions’ exposures to climate-related financial risks, consistent with the risk management framework described in existing FDIC rules and guidance. In noting the “urgent” need for such a Statement of Principles, the FDIC stated that “[c]limate-related financial risks pose a clear and significant risk to the U.S. financial system and, if improperly assessed and managed, may pose a threat to safe and sound banking and financial stability.”24

To alleviate the burden on smaller financial institutions, at this time, the proposed Statement of Principles would be applicable to large financial institutions with over $100 billion in total consolidated assets. The comment period closed June 3, 2022 and comments are under evaluation. The FDIC’s proposed principles are substantially similar to those proposed by the Office of the Comptroller of the Currency (OCC) in December 2021, the comment period for which has also closed. While these are principles that could lead to further guidance, banking regulators have suggested that all banks should already be considering climate-related risks in their risk management frameworks.

Meanwhile, on June 15, 2022, the Basel Committee on Banking Supervision (BCBS) finalized its own principles on climate risk management, which are broadly aligned with the OCC and FDIC proposed principles. Generally, in terms of impact, Basel III standards are minimum requirements which apply to internationally active banks. In recent commentary, Fitch Ratings commented that “[t]he Basel Committee on Banking Supervision’s principles for the effective management and supervision of climate-related financial risks will lead to increased reputational and conduct risks for banks as regulators step up their scrutiny of banks’ climate risk and sustainability pledges.”25

For financial institutions subject to SEC oversight, the provisions of these disclosures may prove more complicated than for other industries. As both the Bank Policy Institution and American Bankers Association noted in their responses to the SEC’s request for public input on climate disclosures, financial institutions are in a unique position. Due to their activities, financial institutions will be largely reliant on various stakeholders, such as clients and third parties, to gather and provide information on the climate impacts of such borrower’s activities. These clients may not be subject to regulatory requirements, and therefore, may not have processes currently in place for the level of data collection that will likely be required. Yet, even for clients who are subject to regulatory requirements, efforts to collect the types of data across all industries, as suggested by Gensler, are still in early stages. Additionally, once the data required to be collected and disclosed is finalized, financial institutions will still need to develop internal processes to collect and organize this data from clients, which will be time-consuming.

ESG for the real estate industry

As described above, ESG and a focus on sustainability are not new to the real estate industry; however, as with other industries, there is a renewed focus in response to regulatory stakeholder interest. Two areas of significance include appraisals, and property valuation and green leasing.

Historically, there has been a disconnect in commercial real estate between building developers, owners, and investors when attempting to identify the best method of analyzing an investment in energy efficient, green building, or high-performance building features. This challenge is often reflected in the appraisal process, where a lack of information exchange can lead to missed opportunities and valuations that do not effectively incorporate the costs and benefits of energy efficiency. Commercial appraisers can play a critical role by appropriately valuing energy performance and high-performance building features in the appraisal process and providing accurate information for real estate investors seeking to increase value through energy efficient strategies. The Department of Energy Better Buildings Initiative has developed resources to help simplify the information gathering processes, provide industry background and context for owners, lenders, and appraisers, and link to key training opportunities that will assist appraisers in gathering the data and developing the skills needed to competently appraise high-performance commercial buildings and building attributes. These resources are part of a free toolkit.26

Including energy efficiency savings in property valuation requires an understanding of who pays for the energy in a given property class and how this payment impacts (or doesn’t impact) the overall net operating income (NOI) of a property class, as these are key factors in determining long-term value, whether using a present value calculation or a cap rate based on NOI.

Green Lease Leaders was developed by the Institute for Market Transformation and the Department of Energy’s Better Buildings Alliance to set national standards for green leases and to recognize firms and brokers that are successfully incorporating green lease language into new or existing leases to save energy in buildings. Many publicly traded landlords participate in this program and the Energy Star program in order to score buildings and tenant spaces for the purpose of quantifying and qualifying their investments in building systems and determining how to save tenants from common area maintenance and operating expenses in a given building. Each year, more landlords join the Green Leasing program, disproving the notion that green lease language is difficult or delays lease signings. In response to demands from their constituencies, more and more Fortune 100s and 500s are asking for these types of features in leases: air quality, lighting, materials, energy consumption, waste, water consumption, recycling, GHG emissions, energy monitoring, and metering and sharing the payment for energy saving devices and payback periods, to name a few.

MAJOR TRENDS DRIVING ESG

Most of the megatrends and issues we face today are based in ESG issues. The following list is illustrative but certainly not exhaustive.

Renewed focus on health and wellness

The current pandemic has brought concerns about health and wellness to the forefront, affecting social norms and operational protocols. These concerns create both risks and opportunities in the real estate industry. Workforce development and the importance of health and wellness in CRE are setting new expectations for building operations and engaging stakeholders such as tenants, residents, employees, and the communities where real estate invests. The Urban Land Institute issued a survey in 2021 asking about CRE’s response to COVID-19. Of those who implemented building health and wellness measures (pre-COVID-19 and during COVID-19), respondents on average implemented six out of the nine space layout measures, five out of the seven occupancy control measures, and three out of the 10 equipment measures, with over half stating they will keep the equipment measures in place permanently, such as upgrades to HVAC equipment and increased energy efficiency. Additionally, tenants are beginning to focus on labeling and certifications, and determining whether their landlord is or is not WELL or Fitwel-certified.

Racial, economic, and social anxiety

Unrest due to economic inequality, racial injustice, housing unaffordability, and other causes has focused attention on social issues, particularly over the last few years. Again, these issues create not just risks, but opportunities within our companies and communities. Beginning in 2020, the SEC required regulated entities to include human capital disclosures in their Form 10-Ks if such disclosures are material to understanding the entity’s business as a whole. A survey of the first year of the disclosures in the CPA Journal found “a wide variety in the human capital disclosures of … different companies,” which is to be expected given the lack of definite parameters provided by the SEC in its final rule.27 In August 2021, Gensler indicated that he asked SEC staff “to propose recommendations for the Commission’s consideration on human capital disclosure,” including metrics “such as workforce turnover, skills and development training, compensation benefits, workforce demographics including diversity, and health and safety.”28

Climate risk and climate reality

There is a growing recognition that we are already experiencing the impacts of climate change today, creating renewed focus and urgency on environmental targets for emissions reduction and net zero commitments. Climate risk poses both physical and transition risks that companies will need to confront. Physical risks are defined by the BCBS as “[e]economic costs and financial losses resulting from the increasing severity and frequency of: extreme climate change-related weather events (or extreme weather events) …; longer-term gradual shifts of the climate …; and indirect effects of climate change,” such as desertification and water shortage.29 Physical risks may cause losses to assets and property, and disrupt business operations and economic activity. Transition risks are “risks related to the process of adjustment towards a low-carbon economy,” which may result in lower valuations of assets.30 These physical and transition risks create financial risk implications for real estate assets. According to Deloitte:

- A majority of U.S. state insurance regulators expect all types of insurance companies’ climate change risks to increase over the medium to long-term—including physical risks, liability risks, and transition risks.

- More than half of the regulators surveyed also indicated that climate change was likely to have a high impact or an extremely high impact on coverage availability and underwriting assumptions.31

With those factors in mind, regulators are looking to new processes for due diligence, underwriting, value at risk analysis, and implications for allocations. Though moving at a slower pace than in the US, the EU is seeing similar response from banks. Costs are going up for two reasons: catastrophic loss from more frequent and intense storms, water damage, and floods; and the values at risk have grown exponentially over time.

Technological disruption and cyber risk

The acceleration of new technologies and disruptive business models such as smart buildings, electric vehicles, and cheap solar power can upend many strategic assumptions and risk profiles. The real estate industry is experiencing an unprecedented investment in property technology and many of the traditional business transaction processes and services are being reimagined with the usage of technology and software. Forbes reports that the fast-track of property technology in the real estate industry accelerated by 1,072 percent from 2015 to 2019. Other accounts reveal that in 2020, 81 percent of real estate organizations planned to use new digital technologies in traditional business processes.

Triple bottom line revisited and the benefits of ESG in real estate investing

It is a demographic reality that investment and employment decisions are increasingly being made by millennials, women, and other groups that strongly believe that their money should align with their values. Institutional investors also see this value. As Larry Fink said in his 2021 letter to CEOs: “This is the beginning of a long but rapidly accelerating transition … we have seen how purposeful companies, with better environmental, social, and governance (ESG) profiles, have outperformed their peers. During 2020, 81% of a globally representative selection of sustainable indexes outperformed their parent benchmarks.”32 Since the early 1990s when the phrase “triple bottom line” was allegedly coined by John Elkington (referring at the time to “people, planet, profit”), there has been a slow rise of the ESG mindset in investing, including real estate investing. This focus has reached a tipping point over the past few years, with a rebirth of the former phrase in what has been referred to as Four Pillars: Planet (E), People (S), Principles of Governance (G), and Prosperity (P), with Prosperity arguably being a broader focus than the profit-centered prong.33

For the real estate industry, benefits of this renewed focus include:

- Better adherence to regulation, and document policies and procedures for compliance;

- Reduced utility cost and consumption, which leads to enhanced NOI;

- Improved ability to identify and prioritize strategies for operational improvements—both opex and capex—that modernize buildings and create competitive advantage;

- Higher rents, occupancy levels, and asset values at properties better able to adapt to and withstand climate risks (e.g., water availability, flooding, wildfires, air quality, etc.);

- Ability to timely and accurately respond to increased local and regional regulation requiring energy disclosures (e.g., 38 states have required disclosure requirements);

- Ability to timely and accurately respond to increased local and regional regulation requiring commissioning disclosure and investments (e.g., Local Law 97 in New York City);

- Enhanced ability to attract and retain millennial and Generation X talent; and

- Ability to attract and retain Fortune 100s and 500s tenants who are interested in ESG and sustainability features.

CONCLUSION

Irrespective of where companies are on their ESG journey, they are undoubtedly paying more attention to ESG now than they were five years ago. The reasons abound: mandatory disclosure requirements, consumer interest and demand, rising and committed shareholder activism, regulatory mandate for action, seismic shifts and inflows of investment dollars into the social impact and ESG space, peer pressure, and the increasing numbers of public companies either tying their credit facility interest rates to ESG key performance indicators (KPIs) or requiring their senior officers to meet certain ESG KPIs to earn their bonus targets. Pick your poison and decide whether you believe it is some or all of these factors that are continuing to telegraph that ESG is not a “flash in the pan.” Rather, it is likely that

ESG has and will continue to embed itself into public and private company decision-making in the real estate arena and beyond.

A recent November 2021 PwC study found that 49 percent of global investors would divest from companies that are not taking sufficient action on ESG issues and 79 percent identified a firm’s management of ESG risks and opportunities as an important factor in investment-making decisions.34 In June 2021, over 550 organizations representing over $35 trillion in total value, responded to the SEC’s request for comment on climate disclosure and indicated that they were in favor of mandatory climate disclosure.

In our view, the ESG train has most assuredly left the station and it will continue to pick up additional steam as time and public policy continue to shape and impact its journey. If we do not learn its nomenclature, as well as its rules and pressure points, we will likely be left behind at the station.

Authors

DEBORAH CLOUTIER, CRE, has over 30 years of experience positioning companies as leaders in sustainability. She is the President and founder of RE Tech Advisors, LLC (retechadvisors.wpenginepowered.com), a Blackstone preferred provider of consulting services to decarbonize and improve ESG performance of investment portfolios. RE Tech’s interdisciplinary team of energy, sustainability, and technical experts guides commercial real estate owners, private equity investors, manufacturers, corporations, and national and local governments. RE Tech designs and deploys award-winning ESG strategies, net zero master plans, and energy engineering services to create a cleaner future, improve asset and fund performance, and comply with the evolving landscape of regulation. Deborah is also the Chief Sustainability Officer of Legence (www.wearelegence.com), an Energy Transition Accelerator™ that provides advisory services and implementation focused on financing, designing, building, and servicing complex systems in mission-critical and high-performance facilities.

BRAD A. MOLOTSKY is a partner at Duane Morris. His primary practice is focused in the areas of opportunity zone fund creation and fund deployment, financing, public-private partnership (PPP or P-3), real estate joint ventures (including mixed-use, life sciences, and multi-family development), commercial leasing (including a focus in cannabis leasing), and acquisitions and divestitures. Prior to joining Duane Morris, for nearly 20 years, Brad served as executive vice president, general counsel, and corporate secretary of Brandywine Realty Trust. During his tenure, the company grew from 40 buildings to approximately 300 buildings, totaling 28 million square feet. In 2020, Brad was named a national influencer in the Opportunity Zone space by OZ Magazine and won The Philadelphia Inquirer Influencers of Law Award for Real Estate. He was named by The Philadelphia Inquirer as an Influencer of Real Estate for Real Estate Legal Excellence in 2019. He was named in The Legal Intelligencer’s list of Pennsylvania Trailblazers for 2019 and one of Philadelphia Business Journal’s 2018 Best of the Bar: Top Lawyers in Philadelphia. Brad has earned his LEED AP O+M certification and an AV Preeminent peer review rating from Martindale-Hubbell.

ANNETTE MICHELLE (SHELLI) WILLIS is a partner at Troutman Pepper Hamilton Sanders LLP. She advises executive management teams, boards of directors, and business leaders. Shelli’s clients include financial institutions such as national and major regional banking institutions, publicly traded companies, and life insurance companies, as well as commercial real estate developers, investors, and joint venture partners. She regularly handles a variety of real estate investment and financing matters ranging throughout the life cycle of a real estate investment. Shelli previously served for more than six years as a deputy general counsel and assistant corporate secretary for SunTrust (now Truist). She is experienced in the integration of ESG objectives and initiatives; diversity, equity and inclusion (DE&I) initiatives; and human rights, into corporate structure, missions, business planning, and public disclosures, with a particular focus on the built environment and the real estate industry.

Notes

1 Larry Fink, 2022 Letter to CEOs, BlackRock (2022), availableat https://www.blackrock.com/corporate/investorrelations/larry-fink-ceo-letter.

2 The ESG premium: New perspectives on value and performance, McKinsey & Co. (Feb. 12, 2020), available at https://www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-newperspectives-on-value-and-performance.

3 PwC’s 25th Annual Global CEO Survey: Reimagining the outcomes that matter, PwC (Jan. 17, 2022), available at https://www.pwc.com/gx/en/ceo-agenda/ceosurvey/2022.html.

4 The Hague District Court, Milieudefensie et al. v Royal Dutch Shell plc, NL:RBDHA:2021:5339 (May 26, 2021), available at https://uitspraken.rechtspraak.nl/inziendocument?id=ECLI:NL:RBDHA:2021:5339.

5 Maddy Lauria, Investors call for DuPont to report on plastic pollution, Del. Bus. Times (Jul. 9, 2021), available at https://delawarebusinesstimes.com/news/dupontreports-plastic-pollution/.

6 Our Next Step in ESG: A New Emissions Reduction Program, Blackstone, Sept. 29, 2020, available at https://www.blackstone.com/insights/article/our-next-step-inesg-a-new-emissions-reduction-program/.

7 The Wall Street Journal on Blackstone’s Two New Diversity Initiatives, Blackstone, Oct .22, 2020, available at https://www.blackstone.com/insights/article/the-wall-streetjournal-on-blackstones-two-new-diversity-initiatives/.

8 Id.

9 About the International Sustainability StandardsBoard, IFRS, available at https://www.ifrs.org/groups/international-sustainability-standards-board/.

10 Commission Guidance Regarding Disclosure Related to Climate Change, Exchange Act Release Nos. 33-9106; 34-61469 (Feb. 8, 2010), available at https://www.sec.gov/rules/interp/2010/33-9106.pdf.

11 Allison Herren Lee, Statement on the Review of Climate- Related Disclosure, (Feb. 24, 2021), available at https://www.sec.gov/news/public-statement/lee-statementreview-climate-related-disclosure.

12 Risk Alert, The Division of Examinations’ Review of ESG Investing (Apr. 9, 2021), available at https://www.sec.gov/files/esg-risk-alert.pdf.

13 Gary Gensler, Prepared Remarks Before the Principles for Responsible Investment “Climate and Global Financial Markets” Webinar (Jul. 28. 2021), available at https://www.sec.gov/news/speech/gensler-pri-2021-07-28.

14 Sample Letter to Companies Regarding Climate Change Disclosures, Div .of Corp. Fin. (Sept. 22, 2021), available at https://www.sec.gov/corpfin/sample-letter-climatechange- disclosures.

15 Caroline A. Crenshaw, Remarks at the PepsiCo-PwC CPE Conference: Controlling Internal Controls (Nov. 16, 2021), available at https://www.sec.gov/news/speech/crenshawcontrolling-internal-controls-20211116.

16 Paul Munter, Statement on OCA’s Continued Focus on High Quality Financial Reporting in a Complex Environment (Dec. 6, 2021), available at https://www.sec.gov/news/statement/munter-oca-2021-12-06.

17 Proposed Rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors, Release Nos. 33-11042; 34-94478, Mar. 21, 2022, available at https://www.sec.gov/rules/proposed/2022/33-11042.pdf.

18 https://www.whitehouse.gov/briefing-room/presidentialactions/2021/05/20/executive-order-on-climate-relatedfinancial-risk/

19 See Risk Alert, supra note 12.

20 Lael Brainard, Financial Stability Implications of Climate Change (Mar. 23, 2021), available at https://www.federalreserve.gov/newsevents/speech/ brainard20210323a.htm.

21 Tommy Wilkes and Ritvik Carvalho, $15 trillion and counting: global stimulus so far, Reuters (May 11, 2020), available at https://www.reuters.com/article/uk-healthcoronavirus-cenbank-graphic/15-trillion-and-countingglobal- stimulus-so-far-idUKKBN22N2EP.

22 Commercial Property Assessed Clean Energy (C-PACE): A Fact Sheet for State and Local Governments, Dept. of Energy (Oct. 2017), available at https://www.energy.gov/ sites/prod/files/2017/10/f39/FL1710_WIP_CPACEv2.PDF.

23 FDIC Statement of Principles for Climate-Related Financial Risk Management for Large Financial Institutions, 87 Fed. Reg. 19507 (Apr. 4, 2022), available at https://www.govinfo. gov/content/pkg/FR-2022-04-04/pdf/2022-07065.pdf.

24 Statement by Martin J. Gruenberg, Acting Chairman, FDIC Board of Directors on the Request for Comment on the Statement of Principles for Climate-Related Financial Risk Management for Large Financial Institutions, FDIC, Mar. 20, 2022, available at https://www.fdic.gov/news/ speeches/2022/spmar3022.html#_ftn1.

25 Basel Climate Principles Will Raise Reputational Risk for Banks, Fitch Ratings, June 30, 2022, available at https://www.fitchratings.com/research/banks/baselclimate-principles-will-raise-reputational-risk-forbanks-30-06-2022.

26 For more information on ESG considerations in appraisals, see the Appraisal Foundation’s New Valuation Guidance for Green Buildings, available at https://betterbuildingssolutioncenter.energy.gov/beat-blog/appraisal-foundations-new-valuation-guidance-greenbuildings.

27 Ganesh M. Pandit, First Look at the Human Capital Disclosures on Form 10-K: Analyzing the SEC Mandate and Comparing it to SASB and EU Standards, CPA Journal, Oct. 2021, available at https://www.cpajournal.com/2021/10/27/first-look-at-the-human-capitaldisclosures-on-form-10-k/.

28 Gary Gensler, Prepared remarks at London City Week, June 23, 2021, available at https://www.sec.gov/news/speech/gensler-speech-london-city-week-062321.

29 Basel Committee on Banking Supervision, Climate-related risk drivers and their transmission channels, at v, Apr. 2021, available at https://www.bis.org/bcbs/publ/d517.pdf.

30 Id.

31 How insurance companies can prepare for risk from climate change, Deloitte, available at https://www2.deloitte.com/us/en/pages/financial-services/articles/ insurance-companies-climate-change-risk.html.

32 Larry Fink’s 2021 letter to CEOs, BlackRock (2021), available at https://www.blackrock.com/us/individual/2021-larryfink-ceo-letter.

33 Bill Thomas, How to measure progress in building a sustainable future, World Economic Forum, Jan. 27, 2021, available at https://www.weforum.org/agenda/2021/01measure-progress-building-sustainable-future/.

34 PwC’s 2021 Global investor survey: The economic realities of ESG (Dec. 2021), available at https://www.pwc.com/gx/en/corporate-reporting/assets/pwc-global-investorsurvey-2021.pdf.

This article originally appeared in ALI CLE’s The Practical Real Estate Lawyer; find out more at www.ali-cle.org.

*This article is based on a submission for the Spring 2022 ACREL Papers. The authors would like to acknowledge the assistance of Adrianna C. ScheerCook of Troutman Pepper and Jack Davis of RE Tech Advisors.